The company's board must then submit a tax return covering the income and wealth for which they request advance tax assessment. Advance tax assessmentįoreign companies must submit a tax return and request advance tax assessment in Norway before they cease trading and are liquidated in their home country. Step 3) Choose the year in the Prior Year Returns section. Step 2) Click on Prior Years at the top of the screen.

TAX RETURN PAPERS FOR FREE

To avoid an enforcement fine for non-submission, the application should be sent well before the submission deadline for the tax return. Print your completed tax returns for free If you prepared a tax return from 2012-2020 using FreeTaxUSA, heres how to print a copy of your return: Returning users: Step 1) Sign In to Your Account. You can apply for an exemption by logging in and filling out the contact form.

The exemption may be granted if the business activity in Norway in the income year, has been excepted from taxation in Norway according to a tax treaty. The application must be submitted by the deadline for submission of the tax return.Īpply for an extension Application for exemption from submitting a tax returnĪs a foreign enterprise you may apply for an exemption from submitting a tax return.

No extensions will be granted beyond this date. Private limited companies and other enterprises that prepare annual accounts under the Accounting Act or IFRS (International Financial Reporting Standards) must submit Income statement 2 as an electronic attachment to the tax return or company tax return.įoreign companies with limited tax liability to Norway and have tax municipality 2312, must submit RF-1045 as an attachment to their tax return.Īpplication for extended submission deadline for the tax returnīusinesses can apply for extended deadline. New deadline for businesses who are granted an extension, will be 30 June. RF-1028 Tax return for public limited companies etc.If you live in the Netherlands for an entire calendar year, you can also file a tax return in other ways.

TAX RETURN PAPERS FULL

If you want to provide additional information or amend your tax return after you have filed it, request a new M Form, complete it in full and return it to the Tax and Customs Administration Filing a tax return from the Netherlands Providing additional information or amending your tax return Tip: if you have difficulty completing the M Form, you may be able to get help (information in Dutch).

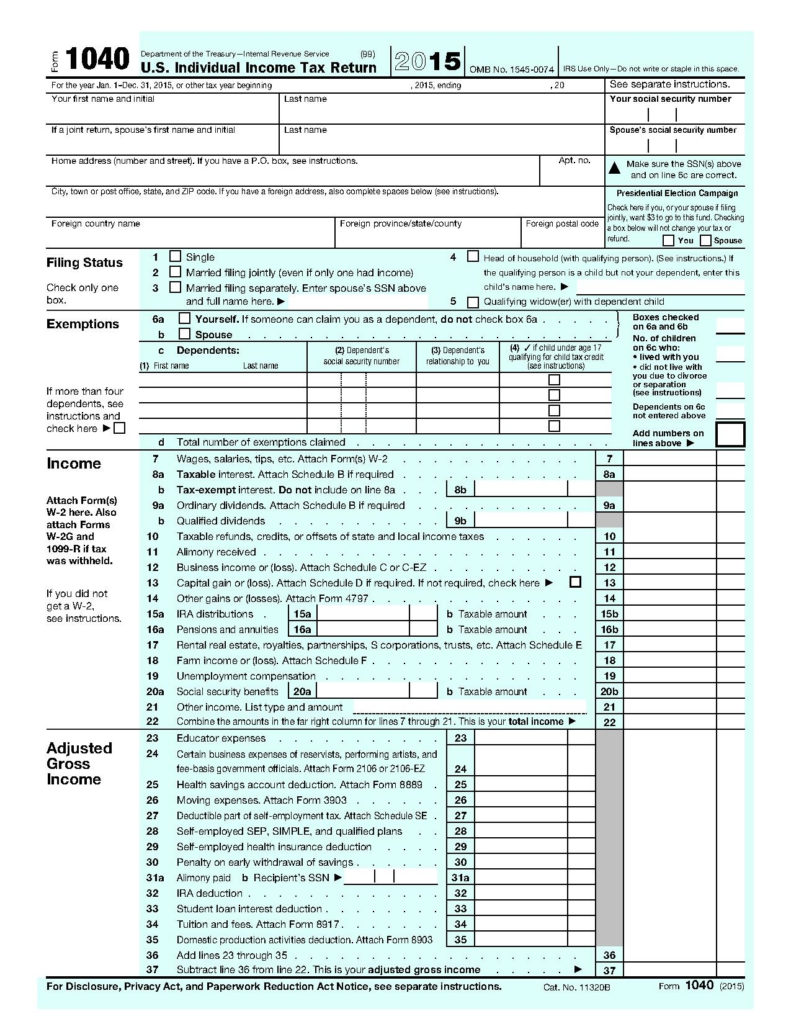

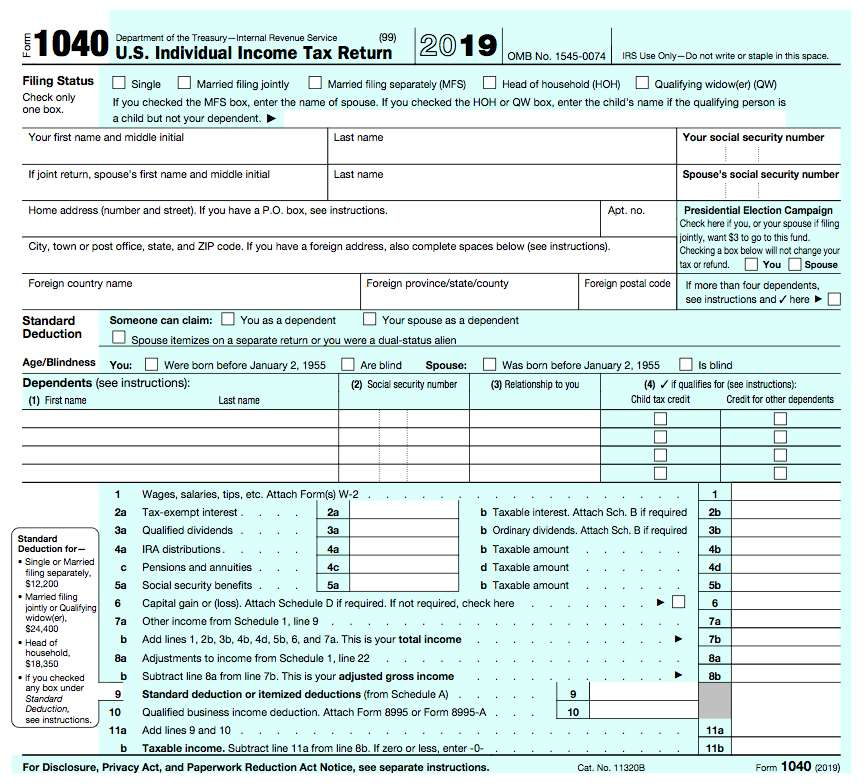

If an employer (s) do not provide you your W-2 forms or the issuer (s) of a 1099 Form does not mail them to you on time, contact them and request it. You can complete a paper M Form instead if you prefer. This is for the simple reason that all 2021 Forms need to be mailed to you before February 1, 2022. You will need a DigiD or an EU-approved login key from another European country to do this. Online M Formįor 2020 and the years thereafter, you can normally complete an online M Form via Mijn Belastingdienst (information in Dutch). If you moved to the Netherlands in, say, 2019 you will need the 2019 M Form. Swarthmore Colleges Financial Aid Office may request a copy of the 1040 (and Schedules 1 through 6, if any are applicable for your. Your 1040 is what you will use to complete the FAFSA and CSS Profile. federal income tax return that you submit to the Internal Revenue Service (IRS) each year. Check with the tax authority in the country you are leaving what matters you have to settle there.Įach tax year has its own M Form. The 1040 form is the main part of the U.S.

0 kommentar(er)

0 kommentar(er)